|

Patrick Dunleavy, Prof at the LSE:

"On her first weekend in office, May created a Cabinet in which 21 of the 24 members were new to the role they were playing … The end result of all this shaking up the personnel? May got the political balance she needed to convert to a ‘hard Brexit’ strategy of leaving the EU fast and curbing immigration, so as to attract UKIP voters back to the Tory ranks. But meanwhile almost all ministers spent a year learning their new roles, organizing reviews of policy, and getting almost nothing done. "The May team’s interfering did not stop at ministers though. In a little recognized but very consequential move for how Whitehall operates, a veritable putsch was organized to get rid of all the senior officials that May disliked (essentially anyone ‘speaking truth to power’). Instead, one by one, May’s team bullied the Cabinet Secretary, Jeremy Heywood, into replacing 5 out of 18 Permanent Secretaries across Whitehall, plus the vitally important head of the UK’s COREPER delegation in Brussels, so as to bring in officials more compliant to Downing Street’s complete hegemony. A further 8 Perm Secs were already new to their roles, not having held posts at the 2015 general election. ... "But the end result has been that two thirds of the Cabinet of ministers struggling with their new roles are also being advised by new-to-the-job Permanent Secretaries. And the senior civil service’s ability to offer frank advice has been cowed by the PM’s detailed insistence on everything going her way." [Why did she not go for a “national unity”, grand coalition after the Brexit vote?]

0 Comments

The Guardian reports that "despite the constantly evolving technological landscape that means more communications can be gathered and examined quickly, making sense of the material itself remains a primary obstacle to security." ...

"less than a quarter of MI5’s 4,000 staff are believed to be involved in analysis, and a far smaller number are sited among the 2,500 staff of MI6 – as few as 100, according to Davies. Although it is true that most of the 8,000 employees in GCHQ can be categorised as analysts, they have to evaluate a vast daily data stream that runs to countless terabytes. A single terabyte is the equivalent of 1,024 gigabytes, with a gigabyte the equivalent of 1.5 million WhatsApp messages." At Our World In Data, Hannah Ritchie writes:

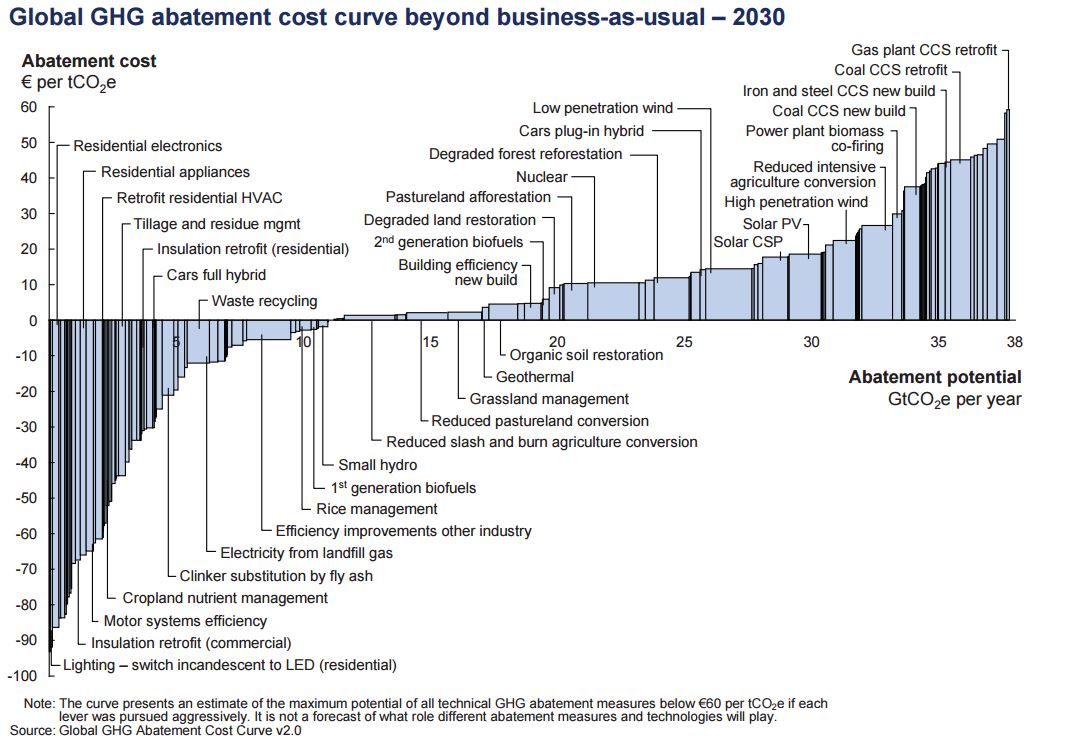

"An abatement cost curve measures two key variables, as shown on McKinsey’s chart below: abatement potential and the cost of abatement. ‘Abatement potential’ is the term we use to describe the magnitude of potential GHG reductions which could be technologically and economically feasible to achieve. We measure this in tonnes (or thousand/million/billion tonnes) of greenhouse gases (which is abbreviated as carbon dioxide equivalents, or CO2e). Note that our measure of CO2e includes all greenhouse gases, not just CO2. So, on the x-axis we have the abatement potential of our range of options for reducing our GHG emissions; here, each bar represents a specific technology or practice. The thicker the bar, the greater its potential for reducing emissions. "On the y-axis we have the abatement cost. This measures the cost of reducing our GHG emissions by one tonne by the year 2030, and in this case is given in € (i.e. € per tonne of CO2e saved). But it’s important to clarify here what we mean by the term ‘cost’. ‘Cost’ refers to the economic impact (which can be a loss or gain) of investing in a new technology rather than continuing with ‘business-as-usual’ technologies or policies. To do this, we first have to assume a ‘baseline’ of what we expect ‘business-as-usual’ policies and investments would be. This is done—for both costs and abatement potential—based on a combination of empirical evidence, energy models, and expert opinion. This can, of course, be challenging to do; the need to make long-term predictions/projections in this case is an important disadvantage to cost-abatement curves. … "if we look at the lowest end of the scale we see that installing energy efficient lighting is the cheapest option (providing a high economic return through efficiency savings). However, its total abatement potential is very limited. If we were looking for an investment which could save a large quantity of GHGs, we might have to select an option which is more expensive, but has a greater abatement potential. The trade-off between cost and potential is an important one." In the NYRB, Roderick MacFarquhar reviews Ian Johnson's new book, The Souls of China:

"Chinese religion, Johnson writes, had little to do with adherence to a particular faith. Instead, it was primarily “part of belonging to your community" ... Johnson explains the differences between Chinese religious traditions—Confucianism, Daoism, and Buddhism—and the “Abrahamic” faiths, Judaism, Christianity, and Islam: “Chinese religion had little theology, almost no clergy, and few fixed places of worship.” … for Chinese it was not really a matter of choosing: the three traditional “teachings” were a smorgasbord on offer to all and sundry in the community, and representatives of each would perform on demand, and for a price, their particular rituals on appropriate occasions such as funerals. According to Johnson, “for most of Chinese history, people believed in an amalgam of these faiths that is best described as ‘Chinese Religion.’” And: [Christian] "Missionaries persisted, and though the rate of conversion was disappointing, their influence grew through the establishment of schools, colleges, and hospitals. Sun Yat-sen, the revolutionary who led the struggle that brought down the Qing dynasty in 1912, was converted, as was his successor Chiang Kai-shek. But they were infused with a modernizing zeal that held that traditional Chinese faiths, particularly folk religions, were superstitions and had to be suppressed; hundreds of thousands of folk temples were destroyed. Only the most important Buddhist and Daoist temples survived. … "Assuming these are at least approximately accurate figures, around a third of the country’s 1.3 billion people admit to a need for a faith to sustain them." China has parity in 6 out of 9 areas of conventional capability critical in showdown over Taiwan6/7/2017 Graham Allison writes in the Atlantic:

"Within a month of becoming China’s leader in 2012, Xi specified deadlines for meeting each of his “Two Centennial Goals.” First, China will build a “moderately prosperous society” by doubling its 2010 per capita GDP to $10,000 by 2021 ... If China reaches the first goal— which it is on course to do—the IMF estimates that its economy will be 40 percent larger than that of the U.S. (measured in terms of purchasing power parity) ... "As the Financial Times’s former Beijing bureau chief Geoff Dyer has explained, “The Communist Party has faced a slow-burning threat to its legitimacy ever since it dumped Marx for the market.” Thus the party has evoked past humiliations at the hands of Japan and the West “to create a sense of unity that had been fracturing, and to define a Chinese identity fundamentally at odds with American modernity.” … "2015 RAND study found that by the end of 2017 China will have an “advantage” or “approximate parity” in six of the nine areas of conventional capability that are critical in a showdown over Taiwan, and four of nine in a South China Sea conflict. It concludes that over the next five to 15 years, “Asia will witness a progressively receding frontier of U.S. dominance.” At Science of Us, Thomas MacMillan reports:

"if you’re going to build a joke around a big violation, you need to invest enough time to make it benign. McGraw offered Louis C.K. as an example of a comedian who can get audiences to laugh at shocking, terrible things, because he knows how much to linger on benign qualifiers ahead of the violation, to make something very wrong feel very funny. "McGraw pointed to one of Louis C.K.’s “of course, but maybe” jokes, in which Louis C.K. says that while of course kids with deadly allergies should be protected from exposure to nuts, just maybe “if touching a nut kills you you’re supposed to die.” Louis C.K. spends over a minute setting up the context — he assures everyone that he really believes that dangerous foods absolutely must be kept away from vulnerable people — in order to present the idea that people should just let kids die so that it lands just right. “I think that what Louis C.K. explicitly or implicitly knows is, if he’s going to say something on its own that would be terrifying, he needs to spend time to offset it,” McGraw said. The audience still feels like letting kids die is a shocking idea, which gives the joke its transgressive power, but Louis C.K. has put in the time to make it okay to laugh at that idea." Karl Smith at Niskanen writes:

"The economic growth literature suggests that in a free market economy, r roughly equals g. It was this fact that made me doubt Thomas Piketty’s thesis even before his book was published. In everything he said and wrote, r > g played a major role. Yet r > g is not sustainable. If it was, then you could obtain infinite growth in finite time simply by investing the interest payments from r in private sector capital. "Not coincidently, you can understand this as the inverse of the thesis outlined by Piketty. Suppose r > g lasted in a normal—that is, non-infinite—economy. This would cause a long term divergence between financial claims on the economy (wealth) and economic productivity of the economy (income). "Since that can’t go on forever, it stops. That inability for asset prices to grow unmoored to underlying productivity is the fundamental driver of corrections in asset markets. … In short, the underlying assumption that the economy will grow faster than the interest rate on public debt is well-grounded, both theoretically and empirically. By contrast, the assumptions in Trumps budget are grossly outside the mainstream, completely untenable and deserve all of the criticism they are receiving." And Matt Bruenig, at Jacobin: “The problem with Piketty’s story, which Naidu and his peers get at in various ways, is that it doesn’t match reality. Assets like real estate, equity, and debt are not assessed according to the quantity of savings that go into creating them. They are assessed according to the expectations of how much income those assets will deliver to their owners in the future. Put simply: asset values are forward-looking, not backward-looking. … Ownership of something like a company share does not entail ownership of capital goods in any real sense. It amounts to owning a bundle of legal rights to future flows of income. ... “Piketty may well have everything backwards. If capital increases its ability to extract income from the economy, that would boost the future flow of income that goes to owners of existing assets, and thereby increase the capital share. When a greater portion of the national income is being funneled to owners of assets, the market value of those assets will go up, causing measured wealth to go up as well." Lapham’s Quarterly excerpts a bit of Philip Ball’s The Water Kingdom:

"To the perplexity of Western observers (not least when confronted with Chinese maps), the innate mental compass of the Chinese points not north–south, but east–west. The Chinese people articulate and imagine space differently from Westerners—and no wonder. All of China’s great rivers respect this axis. But two in particular are symbols of the nation and the keys to its fate: the Yangtze and the Yellow River. These great waterways orient China’s efforts to comprehend itself, and they explain a great deal about the social, economic, and geographical organization of its culture and trade. The rivers are where Confucius and Lao Tzu went to think, where poets like Li Bai and Du Fu went to find words to fit their melancholy, where painters discerned in the many moods of water a language of political commentary, where China’s pivotal battles were fought, where rulers from the first Qin Emperor to Mao and his successors demonstrated their authority. They are where life happens, and there is really nothing much to be said about China that does not start with a river." And: “The Yü Ji Tu (“Tracks of Yü” Map), carved in stone sometime before the twelfth century, shows how Chinese cartography was far ahead of anything in Christendom or classical Greece. In medieval maps of Europe the rivers are schematic ribbons, serpents’ tails encroaching from the coast in rather random wiggles. But the Yü Ji Tu could almost be the work of a Victorian surveyor, depicting the known extent of the kingdom with extraordinary fidelity and measured on a very modern-looking grid.” |

AboutThis is my notepad. Archives

January 2018

|

RSS Feed

RSS Feed